- 0

- 이니스프리

- 조회 수 158

| 출처 | https://www.bloomberg.com/news/articles/...hip-market |

|---|

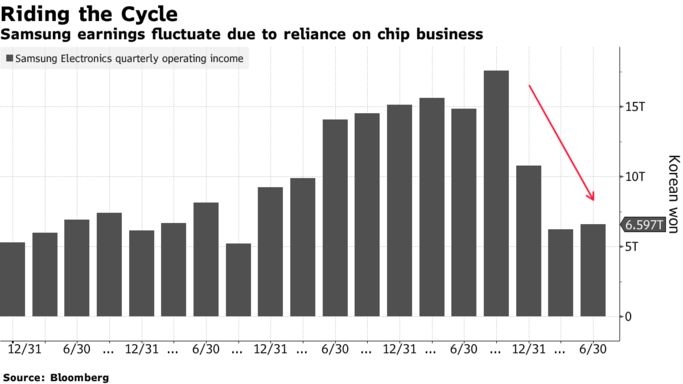

Investors have grown increasingly bullish on Samsung Electronics Co. ahead of its Tuesday results report, betting that the global memory-chip cycle is near a bottom.

The company’s shares have rallied 24% this year, overcoming three straight quarters of disappointing earnings and delayed shareholder return improvement on hopes for an end to the years-long semiconductor downcycle. That’s left some punters questioning how much upside can be left amid concerns including the U.S.-China trade war and South Korea’s spat with Japan.

“The stock may face a short-term correction after the earnings announcement, as the expectation of a rebound in earnings has already been priced in,” said Heo Pil-Seok, chief executive officer at Midas International Asset Management. “Still, from a medium-term perspective, we have confirmed that the semiconductor industry has reached a bottom.”

Shares of Samsung fluctuated Monday, ahead of the company’s preliminary third-quarter results on Tuesday. Analysts estimate it will post operating income of 6.9 trillion won, compared with the record 17 trillion won it reported a year earlier.

While most of the disappointment has been due to declining prices for memory chips, which account for nearly 80% of the company’s operating income, there have been some signs of improvement recently. Spot prices for 4GB DRAM chips fell 0.8% in the third quarter, less than than the 24% drop in the previous quarter.

“The situation in the global memory-chip industry seems to be good, and I guess the third-quarter earnings will be slightly better than the current market consensus,” said Lee Jin-Ho, a fund manager at Eugene Asset Management in Seoul.

(이하 생략)

![[독일 Bild紙] Der größte Knast der Welt | Super-Gefängnis CECOT in El Salvador](/files/thumbnails/018/942/75x50.crop.jpg?t=1677495398)

![[독일 Bild紙] Der größte Knast der Welt | Super-Gefängnis CECOT in El Salvador](/files/thumbnails/018/942/210x140.crop.jpg?t=1677495398)

![[독일 Bild紙] Schüler tritt brutal auf Lehrerin ein](/files/thumbnails/006/942/75x50.crop.jpg?t=1677495340)

![[독일 Bild紙] Schüler tritt brutal auf Lehrerin ein](/files/thumbnails/006/942/210x140.crop.jpg?t=1677495340)

![[독일 Bild紙] Deutscher Wohlstand in Gefahr: Massenhafter Job-Abbau in Deutschland | Kommentar Peter Tiede](/files/thumbnails/000/942/75x50.crop.jpg?t=1677495313)

![[독일 Bild紙] Deutscher Wohlstand in Gefahr: Massenhafter Job-Abbau in Deutschland | Kommentar Peter Tiede](/files/thumbnails/000/942/210x140.crop.jpg?t=1677495313)

![[독일 Bild紙] Schwerer Bob-Unfall im Wintersportparadies Oberhof | Augenzeuge berichtet](/files/thumbnails/866/941/75x50.crop.jpg?t=1677409021)

![[독일 Bild紙] Schwerer Bob-Unfall im Wintersportparadies Oberhof | Augenzeuge berichtet](/files/thumbnails/866/941/210x140.crop.jpg?t=1677409021)

![[독일 Bild紙] Ukrainische Scharfschützen üben im Schnee | Ukraine-Krieg](/files/thumbnails/860/941/75x50.crop.jpg?t=1677408994)

![[독일 Bild紙] Ukrainische Scharfschützen üben im Schnee | Ukraine-Krieg](/files/thumbnails/860/941/210x140.crop.jpg?t=1677408994)

![[독일 Bild紙] Ehe-Streit eskaliert komplett | Heftiger Streit auf einem Parkplatz](/files/thumbnails/854/941/75x50.crop.jpg?t=1677408967)

![[독일 Bild紙] Ehe-Streit eskaliert komplett | Heftiger Streit auf einem Parkplatz](/files/thumbnails/854/941/210x140.crop.jpg?t=1677408967)

![[독일 Bild紙] Lewis Capaldi erleidet Tourette-Anfall auf der Bühne](/files/thumbnails/848/941/75x50.crop.jpg?t=1677408940)

![[독일 Bild紙] Lewis Capaldi erleidet Tourette-Anfall auf der Bühne](/files/thumbnails/848/941/210x140.crop.jpg?t=1677408941)

![[독일 Bild紙] BILD-Chefreporter Peter Tiede erzählt, wie er Putin austrickste #Shorts](/files/thumbnails/842/941/75x50.crop.jpg?t=1677408913)

![[독일 Bild紙] BILD-Chefreporter Peter Tiede erzählt, wie er Putin austrickste #Shorts](/files/thumbnails/842/941/210x140.crop.jpg?t=1677408913)

![[독일 Bild紙] Ein Jahr Ukraine-Krieg: So lebt das Frozen-Mädchen heute](/files/thumbnails/707/941/75x50.crop.jpg?t=1677322620)

![[독일 Bild紙] Ein Jahr Ukraine-Krieg: So lebt das Frozen-Mädchen heute](/files/thumbnails/707/941/210x140.crop.jpg?t=1677322620)

![[독일 Bild紙] Ein Jahr Ukraine-Krieg: So geht es Irina heute](/files/thumbnails/701/941/75x50.crop.jpg?t=1677322593)

![[독일 Bild紙] Ein Jahr Ukraine-Krieg: So geht es Irina heute](/files/thumbnails/701/941/210x140.crop.jpg?t=1677322593)

![[독일 Bild紙] Hund besiegt Hammerhai #shorts](/files/thumbnails/695/941/75x50.crop.jpg?t=1677322564)

![[독일 Bild紙] Hund besiegt Hammerhai #shorts](/files/thumbnails/695/941/210x140.crop.jpg?t=1677322565)

![[독일 Bild紙] Hochseefischer in Gefahr – Angler wird fast von riesigem Speerfisch durchbohrt | Australien](/files/thumbnails/689/941/75x50.crop.jpg?t=1677322540)

![[독일 Bild紙] Hochseefischer in Gefahr – Angler wird fast von riesigem Speerfisch durchbohrt | Australien](/files/thumbnails/689/941/210x140.crop.jpg?t=1677322540)

![[독일 Bild紙] Waffen Bunker unter einem Sofa #shorts](/files/thumbnails/683/941/75x50.crop.jpg?t=1677322513)

![[독일 Bild紙] Waffen Bunker unter einem Sofa #shorts](/files/thumbnails/683/941/210x140.crop.jpg?t=1677322513)

![[독일 Bild紙] Brücke im Zeitraffer #shorts](/files/thumbnails/502/941/75x50.crop.jpg?t=1677236222)

![[독일 Bild紙] Brücke im Zeitraffer #shorts](/files/thumbnails/502/941/210x140.crop.jpg?t=1677236222)

![[독일 Bild紙] Ukraine-Krieg: „Naive Pazifisten bringen keinen Frieden“ | Henryk M. Broder bei „Viertel nach Acht“](/files/thumbnails/496/941/75x50.crop.jpg?t=1677236195)

![[독일 Bild紙] Ukraine-Krieg: „Naive Pazifisten bringen keinen Frieden“ | Henryk M. Broder bei „Viertel nach Acht“](/files/thumbnails/496/941/210x140.crop.jpg?t=1677236195)

![[독일 Bild紙] „Pflegekräfte werden verheizt‘“ | Isabell Volovych bei „Viertel nach Acht“](/files/thumbnails/490/941/75x50.crop.jpg?t=1677236168)

![[독일 Bild紙] „Pflegekräfte werden verheizt‘“ | Isabell Volovych bei „Viertel nach Acht“](/files/thumbnails/490/941/210x140.crop.jpg?t=1677236168)

![[독일 Bild紙] „Der Staat will uns umerziehen“ | Peter Hahne bei „Viertel nach Acht“](/files/thumbnails/484/941/75x50.crop.jpg?t=1677236141)

![[독일 Bild紙] „Der Staat will uns umerziehen“ | Peter Hahne bei „Viertel nach Acht“](/files/thumbnails/484/941/210x140.crop.jpg?t=1677236141)

![[독일 Bild紙] „Mehr Härte gegen die Mullahs!“ | Danial Ilkhanipour bei „Viertel nach Acht“](/files/thumbnails/478/941/75x50.crop.jpg?t=1677236114)

![[독일 Bild紙] „Mehr Härte gegen die Mullahs!“ | Danial Ilkhanipour bei „Viertel nach Acht“](/files/thumbnails/478/941/210x140.crop.jpg?t=1677236114)

![[독일 Bild紙] 🔴 Viertel nach Acht – 22. Februar 2023 | u.a. mit Dr. Alexander Kissler und Patricia Platiel](/files/thumbnails/251/941/75x50.crop.jpg?t=1677149821)

![[독일 Bild紙] 🔴 Viertel nach Acht – 22. Februar 2023 | u.a. mit Dr. Alexander Kissler und Patricia Platiel](/files/thumbnails/251/941/210x140.crop.jpg?t=1677149821)